GOT A UI/UX

DESIGN PROJECT?

The Design Revolution of Online Mutual Funds in India

Of the several disruptive technological innovations, the internet has been one of the most revolutionary discoveries creating a major paradigm shift. It has impacted all aspects of our lives, one of those factors being how we spend and save.

Once a very small player in the financial market, mutual funds now play a large and decisive role in the valuation of tradable assets throughout the world. Let us look at how the advent of technological disruption has changed the course of mutual funds.

Introduction

As the name suggests, a ‘mutual fund’ is an investment vehicle that allows several investors to pool their resources in order to purchase stocks, bonds, and other securities.

These collective funds (referred to as Assets Under Management or AuM) are then invested by an expert fund manager appointed by a mutual fund company (called Asset Management Company or AMC).

Today, online mutual fund platforms not only offer a convenient and hassle-free way of investing in mutual funds but one that is also safe and secure.

As the days of filling multiple application forms for investing in mutual funds or physically going to the fund house to submit the same pass us by, let us look at the history and rise of mutual fund investments online in India.

In this case study, we will explore the history and growth of mutual funds while offering you unique insights Yellowchalk gleaned from its extensive user research while designing a unique online investment product.

History – Around the World

Mutual funds emerged as early as the second half of the 18th century in The Netherlands. The apparent motivation for organizing the first mutual funds was to provide diversification for small investors.

Over the past two decades, mutual funds have become the primary investment for small investors. At the turn of the twenty-first century, the number of mutual funds in the The United States exceeded the number of securities listed on the New York Stock Exchange.

History – The Indian Context

The first company that dealt in mutual funds was the Unit Trust of India. It was set up in 1963 as a joint venture of the Reserve Bank of India and the Government of India. The objective of the UTI was to guide small and uninformed investors who wanted to buy shares and other financial products in larger firms. The UTI was a monopoly in those days and one of its mutual fund products that ran for several years was the Unit Scheme 1964.

Mutual Funds in the Indian Landscape

Mutual fund investments can generally be classified into four types – equity funds, money market funds, debt funds, and hybrid funds. When investors are deciding which to utilize, they usually consider investment strategies that match the level of the risk involved in each scenario.

Compared to direct investments in individual stocks and bonds, mutual funds offer the advantages of liquidity and diversification at a relatively low cost.

The Mutual Fund Industry has seen tremendous growth in the last decade in total. The AuM in India Mutual Fund Industry has grown a whopping four-fold in a decade (2010 – 2020) and stands at 24.55 trillion INR as of May 31st, 2020. It is predicted to grow exponentially by 2025.

Market Overview

With the steep increase in digital penetration, 760 million people have access to smartphones and 700 million people have access to the internet. This data shows us that the current investor in today’s generation is tech-savvy and that has caused a humongous shift in the financial industry.

Several mutual fund advisors have noted that most investors who are signing up for Systematic Investment Plans (SIPs, which are invested monthly or quarterly instead of a lump sum) these days are in their 20s. This can be attributed to the growing awareness among young investors about the benefits of investing in mutual funds through SIPs and their familiarity and ease of using technology.

According to a survey by Tata Capital, those in the 18-25 age group, 39 percent are saving a quarter of their salaries and 14 percent save away more than half.

Zerodha, an Indian trading platform, saw investors in the age group of 20-30 increase to 69% of its total investors, from 50-55% pre-COVID.

The Shift to Online

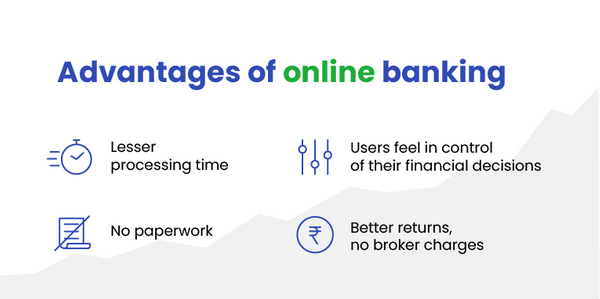

The emergence of online banking transformed not only the banking industry but also had a major impact on other related sectors such as investments and portfolio management.

With the shift of all banking services online like checking account status, fund transfer, loan applications, credit card verifications, shopping portals, etc, not requiring a visit to the branch during office hours were viewed as high-value offerings. It also increasingly started to become a necessity rather than a service. Once institutions recognized the low processing cost per transaction via the internet, they began viewing online banking as an extension of the bank rather than as an add-on service.

The average size of the SIP is about Rs 3,200 per SIP account!

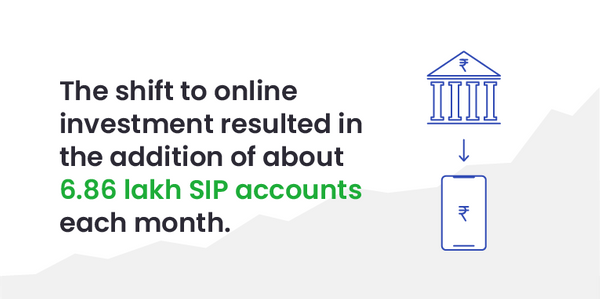

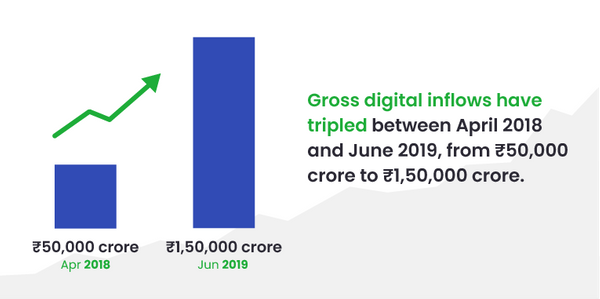

According to the Association of Mutual Funds in India, digital money in the mutual fund industry is growing rapidly. The share went up from 0.5 percent in 2016 to 14 percent in August 2019 due to smartphone and internet penetration. Whereas, inflows through the physical route have been reducing.

SIP accounts have grown three times from April 2016 to August 2019, from 10 million to 27.3 million, which is largely facilitated through easier access and convenience coupled with the ability to enable auto-debit facility from salary accounts digitally.

The biggest deterrent to investing today is the paperwork. Most platforms are trying to minimize the paperwork required and this is exactly where online investment is breaking traditional barriers.

The current generation of tech-savvy investors does not prefer going the offline route with banks and other intermediaries and have a strong preference for investing online. They want the convenience of having all information and resources at their disposal and prefer selecting funds themselves. They want to feel in control over their portfolio and financial decisions without the involvement of middlemen.

This was also coupled with the fact that direct mutual funds provide better returns, generally between 0.5% to 1.5% more than their regular counterparts. This is because the broker’s charges are excluded from the returns. A 1% deduction from a return of 12% from mutual funds, leads to an 8.33% lesser return to the investor, which is a huge amount.

Even with the shift to online investment, there is a certain amount of trust in financial experts. A survey by Investopedia shows that nearly two-thirds (65%) of the 1405 millennials surveyed said they trust financial advisors.

Market Shift

According to the data released by the Association of Mutual Funds in India (AMFI), the Indian mutual funds currently have about 1.27 crore SIP accounts through which investors regularly invest in mutual fund schemes.

Digital Accessibility and Literacy

Digital penetration, government targeting smart cities and increased data speeds are also facilitating the drift of asset share towards smaller cities and towns. Increased retail contribution through SIPs shows the power of digital penetration in India.

Easy access to internet banking has also increased investments from tier two and three cities.

Although their share in the overall inflows is still abysmally small, it is expected to rise rapidly over the next few years.

Increased accessibility paved the way for the new generation of tech-savvy consumers to invest and keep track of their money. With the platforms reaching to the palms of their hands, they could invest, keep track, and plan their savings on the go.

Fund houses are increasingly leveraging technology for various processes, enabling them to reduce processing time and providing better levels of customer service.

The Shift from Web to Mobile

Being KYC compliant is the mandatory criteria to be fulfilled as stated by SEBI.

As laptops and desktops proved not to provide the same ease of use as a mobile for users of all age groups, not all customers could not understand the requirements to go through with the formalities of the process, i.e. taking a selfie with the checkbook in a particular frame, clicking clear images of the required documents, etc.

As a result, most KYC requests ended up getting rejected due to the non-adherence of guidelines.

The deficiency in the design impacts business. This resulted in a heavy dependency on the operations team to manually verify and process the documents making the process complicated for the investor.

Yellowchalk Insights

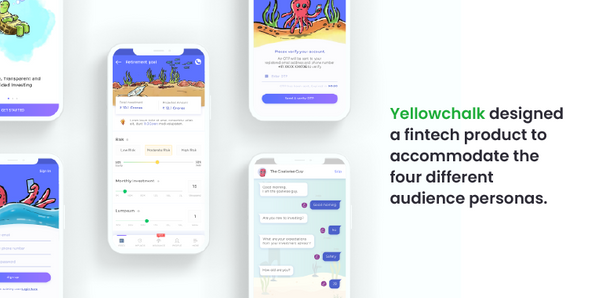

With the rise of online investment, the need for a fintech product that gave control back to the users and leveraged the advantages of UI/UX capabilities was a necessity.

We mapped four different personas based on the users’ familiarity with mutual funds after conducting extensive user research. They were:

- People new to investment/started jobs wanted to save money

- People who invested money but did not got returns

- People who got returns and wanted to reinvestments

- NRIs

Design to Unite

A digital fintech product that empowered all four user groups to start their investment journey and meet their investment goals is an extensive undertaking. Our user research across personas showed us what the ideal online investment platform should consist of:

- Simple design: The design should be usable and focused on the tasks, always meeting the requirements of an Indian mutual fund investor. Since fintech products tend to be data-heavy, this can be done with the help of easy to understand graphs and charts and visually represented data.

- Structured content: The user should be able to find the answer to any query they want within seconds and the content should be structured to guide them intuitively.

- Value-added services: Adding services that go above and beyond just simple transactional relationships can make users engage with fintech products very well. An example would be providing users with suggestions based on the inputs received by them.

- Interactivity: Fintech products and lighthearted design are not natural synonyms – but carrying the principles of clarity and task flows can also be done with the help of a vibrant layout that uses micro-interactions, and gamification to engage the users. and easy-to-understand graphs.

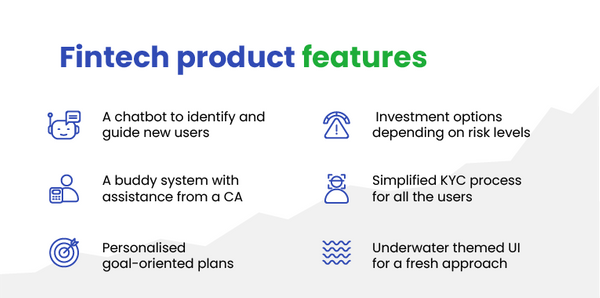

The fintech product included:

- A chatbot to identify and guide new users to their ideal investment goal through a series of questions.

- A buddy system where a chartered accountant would assist the users with suitable investment options, plans, and best practices. The user would also be able to view the investment goals set by their buddy to build transparency and trust.

- A view of different goals a user could save for (a house, tax savings, vacation, retirement). This would make their investment plan goal-oriented and personalized, resulting in continued savings.

- Options for users to invest in different funds based on the level of risk they were willing to take.

- A simplified KYC verification process gave the users the freedom to furnish the required information in parts installment if required while saving the information they had at hand.

- A sense of newness to investment by using an underwater theme to make the investment process feel less daunting and give the users a sense of comfort.

The rise of new-age fintech firms is further expected to accelerate the rise of digital platforms, making it easier for customers to transact digitally, while also reducing processing time and costs for fund houses or investment firms. While we may be moving towards digitization, there is a need to educate customers, especially in tier two and three cities as a lack of awareness about digital transactions results in them being less comfortable to use these modes. Fund houses also need to make sure that they pay adequate heed to issues related to customer privacy, cybersecurity, and data protection.